- Bank Transfer Argentina

- Bank Transfer Brazil

- Bank Transfer Colombia

- Bank Transfer Europe

- Bank Transfer Japan

- Bank Transfer Korea

- Bank Transfer Malaysia

- Bank Transfer Mexico

- Bank Transfer Peru

- Bank Transfer Philippines

- Bank Transfer Poland

- Bank Transfer Taiwan

- Bank Transfer Thailand

- Bank Transfer Vietnam

- Belfius

- Blik

- CBC

- E-Prepag

- eNETS

- EPS

- Faster Payment System

- Financial Process Exchange

- iDeal

- KBC

- Korean Virtual Account

- Kplus

- Krungthainext

- Krungsri Mobile Application

- MBWay

- Multibanco PT

- Mybank

- NetBanking

- PayEasy

- PayID

- PayNow

- Pix

- Przelewy24

- PSE

- Redpagos

- SafetyPay

- SCB Easy

- SEPA Direct Debit

- Sofort

- Thai QR

- UPI

- VietQR

- ATM Transfer Indonesia

- Boleto

- Book Gift Voucher

- Boonterm Kiosk

- Cashbee

- Cash Payment Mexico

- Cash payment UAE

- Cenpay

- Culture Voucher

- Davivienda

- Efectivo

- Efecty

- Eggmoney

- Game-ON

- Gana

- Gudang Voucher

- Indomaret

- Konbini

- MINT

- MyCard Card

- Neosurf

- Openbucks

- Oxxo

- PagoEfectivo

- Payshop

- RapiPago

- T-Money

- Teencash

- Todito Cash

- Wavegame

- 7-Eleven

- Mobile Money

- Akulaku

- Alipay

- Alipay+

- Bitcoin Coinbase

- Boost Wallet

- Cherry Credits

- Dana

- Doku Wallet

- FasterPay

- GCash

- Gopay

- GOCPay

- GrabPay

- JeniusPay

- KakaoPay

- L.pay

- Linepay Taiwan

- LinkAja

- Mcash

- Mobile Banking Tanzania

- MyCard Wallet

- Naver Pay

- OVO

- Paga

- Payco

- PayMaya

- PayPal

- QRIS

- Rabbit LINE Pay

- Razer Gold

- Redcompra

- Sakuku

- Samsung Pay

- ShopeePay Indonesia

- ShopeePay Philippines

- ShopeePay Thailand

- ShopeePay Vietnam

- Singtel Dash

- Taiwan Pay

- Thai QR

- Toss Pay

- Touch 'N Go eWallet

- TrueMoney Wallet

- VNPT Money

- VTC Pay

- Wechat Pay

- ZaloPay

Netbanking

Net banking can be used by any customer who has an active bank account with the bank. A customer is required to register himself/herself to use net banking. Once registered, he/she can start using the banking facilities online.

Payment flow

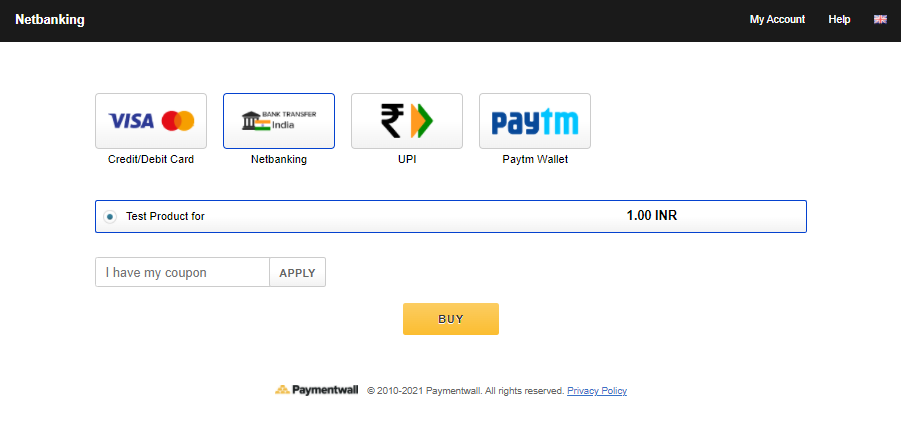

- Step1: Choose Netbanking from the available payment options.

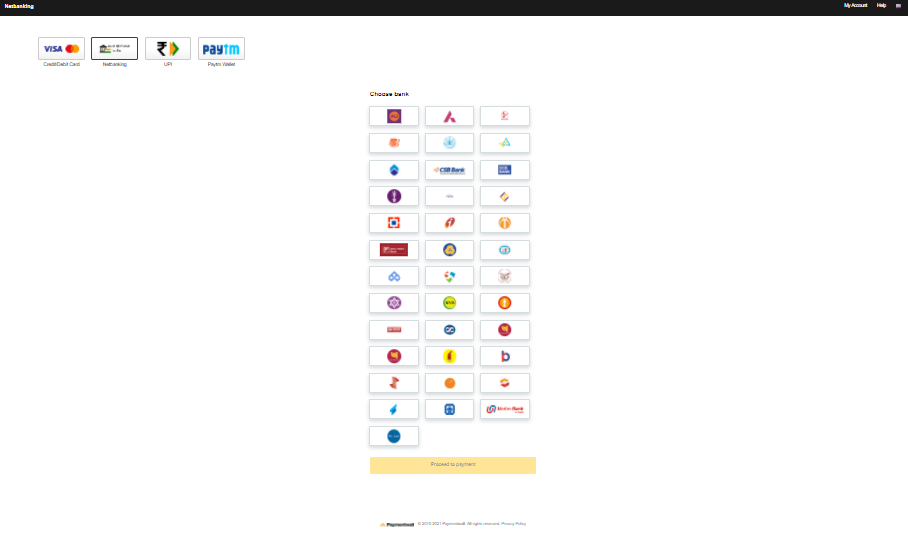

- Step2: Choose Bank then click the Proceed to Payment button.

-

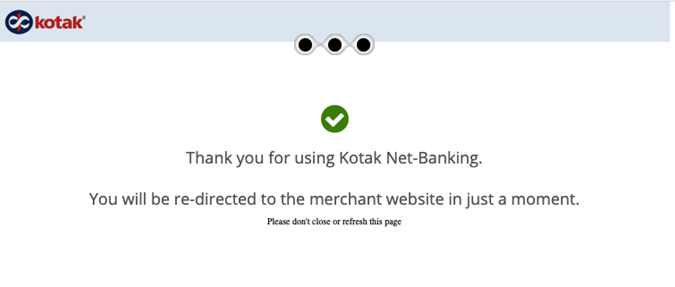

Step3: The user will be redirected to the bank’s page and need to input details to proceed.

-

Step4: Once done with the verification and authentication, the user will receive confirmation that the payment is successful.

Netbanking

| name | description |

|---|---|

| Countries |  IN IN |

| Type | Bank Transfers |

| Processing currencies | INR |

| Supported currencies | Refer to currency codes |

| Payment confirmation time | Instant |

| Chargebacks | Yes |

| Refund | Yes |

| Full Refund | Yes |

| Partial Refund | Yes |

| Refund type | API |

| Refund timeframe | 180 days |

| Onboarding required | Yes (account is for Terminal3 and is available to our merchants via MoR model only) |

| Recurring Payments | No |

| Mobile UI | Yes |

| Opens new window | Yes |

| Min Transaction Limit | 1.00 INR |

Available models:

- Merchant.

Included with your Paymentwall account.

- MOR.

Questions?

Common questions are covered in the FAQ.

For integration and API questions, feel free to reach out Integration Team via integration@paymentwall.com.

For business support, email us at merchantsupport@paymentwall.com.

To contact sales, email bizdev@paymentwall.com.

To suggest a change to this documentation you can submit a pull request on GitHub.