- Bank Transfer Argentina

- Bank Transfer Brazil

- Bank Transfer Colombia

- Bank Transfer Europe

- Bank Transfer Japan

- Bank Transfer Korea

- Bank Transfer Malaysia

- Bank Transfer Mexico

- Bank Transfer Peru

- Bank Transfer Philippines

- Bank Transfer Poland

- Bank Transfer Taiwan

- Bank Transfer Thailand

- Bank Transfer Vietnam

- Belfius

- Blik

- CBC

- E-Prepag

- eNETS

- EPS

- Faster Payment System

- Financial Process Exchange

- iDeal

- KBC

- Korean Virtual Account

- Kplus

- Krungthainext

- Krungsri Mobile Application

- MBWay

- Multibanco PT

- Mybank

- NetBanking

- PayEasy

- PayID

- PayNow

- Pix

- Przelewy24

- PSE

- Redpagos

- SafetyPay

- SCB Easy

- SEPA Direct Debit

- Sofort

- Thai QR

- UPI

- VietQR

- ATM Transfer Indonesia

- Boleto

- Book Gift Voucher

- Boonterm Kiosk

- Cashbee

- Cash Payment Mexico

- Cash payment UAE

- Cenpay

- Culture Voucher

- Davivienda

- Efectivo

- Efecty

- Eggmoney

- Game-ON

- Gana

- Gudang Voucher

- Indomaret

- Konbini

- MINT

- MyCard Card

- Neosurf

- Openbucks

- Oxxo

- PagoEfectivo

- Payshop

- RapiPago

- T-Money

- Teencash

- Todito Cash

- Wavegame

- 7-Eleven

- Mobile Money

- Akulaku

- Alipay

- Alipay+

- Bitcoin Coinbase

- Boost Wallet

- Cherry Credits

- Dana

- Doku Wallet

- FasterPay

- GCash

- Gopay

- GOCPay

- GrabPay

- JeniusPay

- KakaoPay

- L.pay

- Linepay Taiwan

- LinkAja

- Mcash

- Mobile Banking Tanzania

- MyCard Wallet

- Naver Pay

- OVO

- Paga

- Payco

- PayMaya

- PayPal

- QRIS

- Rabbit LINE Pay

- Razer Gold

- Redcompra

- Sakuku

- Samsung Pay

- ShopeePay Indonesia

- ShopeePay Philippines

- ShopeePay Thailand

- ShopeePay Vietnam

- Singtel Dash

- Taiwan Pay

- Thai QR

- Toss Pay

- Touch 'N Go eWallet

- TrueMoney Wallet

- VNPT Money

- VTC Pay

- Wechat Pay

- ZaloPay

Mobile Money Ghana

Mobile money is a digital payment platform that allows to transfer money between cellphone devices. The technology is installed in the SIM card of the device and can be used on regular and smartphone devices. Users can receive, withdraw, and send money without being connected to the formal banking system.

Mobile money is booming in the West African countries. Ghana has the third highest mobile payment usage rate in the world, after China and Kenya.

The development has been quite impressive. The World Bank has recognized Ghana as the fastest-growing mobile money market in Africa over the last five years.

Mobile Money options in Ghana include:

- MTN mobile money

- Airtel mobile money

- TigoPesa

- Vodafone mobile money

- GMoney

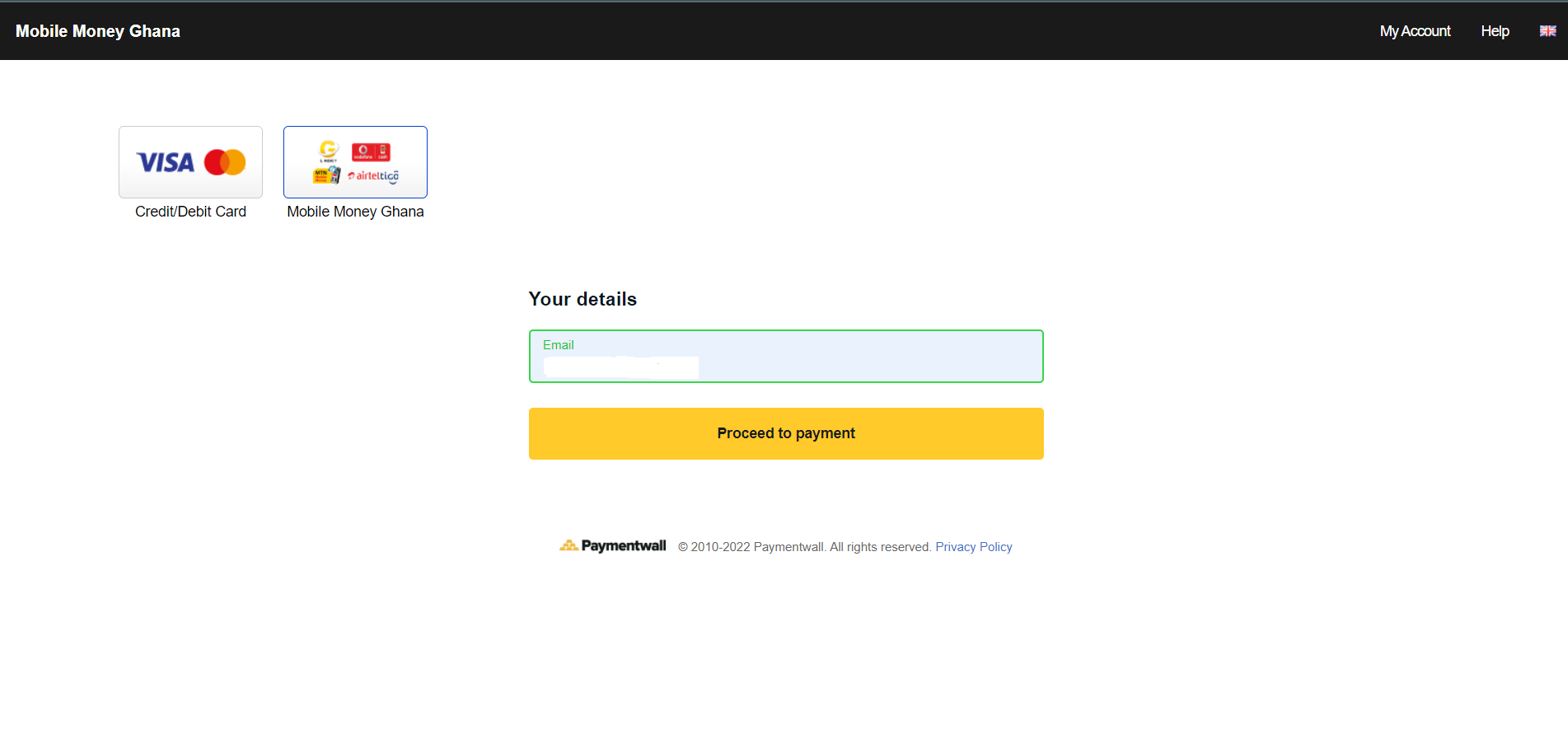

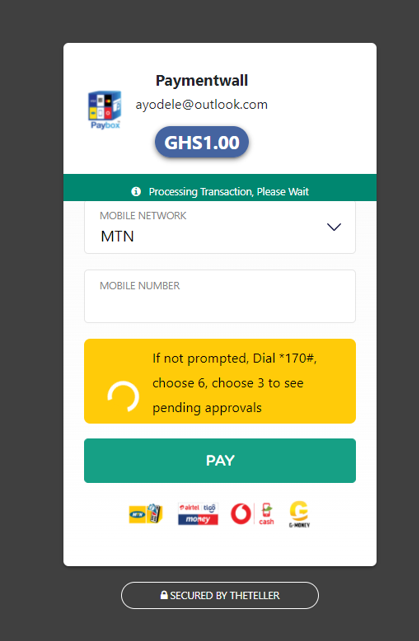

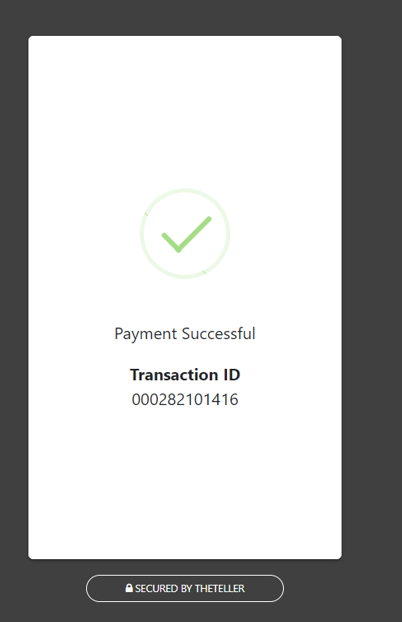

Payment flow

- Choose Mobile Money Ghana option and fill login information.

- Choose Mobile network and fill Mobile numbers.

- Receive successful payment notice.

- Receive Thank you note before closing transaction.

Mobile Money Ghana

| name | description |

|---|---|

| Countries |  GH GH |

| Type | Mobile Money |

| Processing currencies | USD, GHS |

| Supported currencies | Refer to currency codes |

| Payment confirmation time | Instant |

| Chargebacks | No |

| Refunds | No |

| Onboarding required | No |

| Recurring Payments | No |

| Mobile UI | Yes |

| Open new window | Yes |

| Max Transaction Limit | depending on the phone |

| Min Transaction Limit | 1 USD/cedi |

Available integrations:

- Merchant model.

Included with your Paymentwall account.

- MOR model.

Questions?

Common questions are covered in the FAQ.

For integration and API questions, feel free to reach out Integration Team via integration@paymentwall.com.

For business support, email us at merchantsupport@paymentwall.com.

To contact sales, email bizdev@paymentwall.com.

To suggest a change to this documentation you can submit a pull request on GitHub.