- Bank Transfer Argentina

- Bank Transfer Brazil

- Bank Transfer Colombia

- Bank Transfer Europe

- Bank Transfer Japan

- Bank Transfer Korea

- Bank Transfer Malaysia

- Bank Transfer Mexico

- Bank Transfer Peru

- Bank Transfer Philippines

- Bank Transfer Poland

- Bank Transfer Taiwan

- Bank Transfer Thailand

- Bank Transfer Vietnam

- Belfius

- Blik

- CBC

- E-Prepag

- eNETS

- EPS

- Faster Payment System

- Financial Process Exchange

- iDeal

- KBC

- Korean Virtual Account

- Kplus

- Krungthainext

- Krungsri Mobile Application

- MBWay

- Multibanco PT

- Mybank

- NetBanking

- PayEasy

- PayID

- PayNow

- Pix

- Przelewy24

- PSE

- Redpagos

- SafetyPay

- SCB Easy

- SEPA Direct Debit

- Sofort

- Thai QR

- UPI

- VietQR

- ATM Transfer Indonesia

- Boleto

- Book Gift Voucher

- Boonterm Kiosk

- Cashbee

- Cash Payment Mexico

- Cash payment UAE

- Cenpay

- Culture Voucher

- Davivienda

- Efectivo

- Efecty

- Eggmoney

- Game-ON

- Gana

- Gudang Voucher

- Indomaret

- Konbini

- MINT

- MyCard Card

- Neosurf

- Openbucks

- Oxxo

- PagoEfectivo

- Payshop

- RapiPago

- T-Money

- Teencash

- Todito Cash

- Wavegame

- 7-Eleven

- Mobile Money

- Akulaku

- Alipay

- Alipay+

- Bitcoin Coinbase

- Boost Wallet

- Cherry Credits

- Dana

- Doku Wallet

- FasterPay

- GCash

- Gopay

- GOCPay

- GrabPay

- JeniusPay

- KakaoPay

- L.pay

- Linepay Taiwan

- LinkAja

- Mcash

- Mobile Banking Tanzania

- MyCard Wallet

- Naver Pay

- OVO

- Paga

- Payco

- PayMaya

- PayPal

- QRIS

- Rabbit LINE Pay

- Razer Gold

- Redcompra

- Sakuku

- Samsung Pay

- ShopeePay Indonesia

- ShopeePay Philippines

- ShopeePay Thailand

- ShopeePay Vietnam

- Singtel Dash

- Taiwan Pay

- Thai QR

- Toss Pay

- Touch 'N Go eWallet

- TrueMoney Wallet

- VNPT Money

- VTC Pay

- Wechat Pay

- ZaloPay

Linepay Japan

LINE Pay is LINE’s e-wallet, a feature of the popular messaging service used for daily communication in Japan. Since it’s integrated right into the messaging app, the user can use it to send money to their Line contacts. It also allows users to shop at physical and online stores, pay utility bills, and send money to friends within its application.

Once the account is set up, the user can either top up their balance with cash at convenience stores or just link it to their bank account for funding.

Payment flow

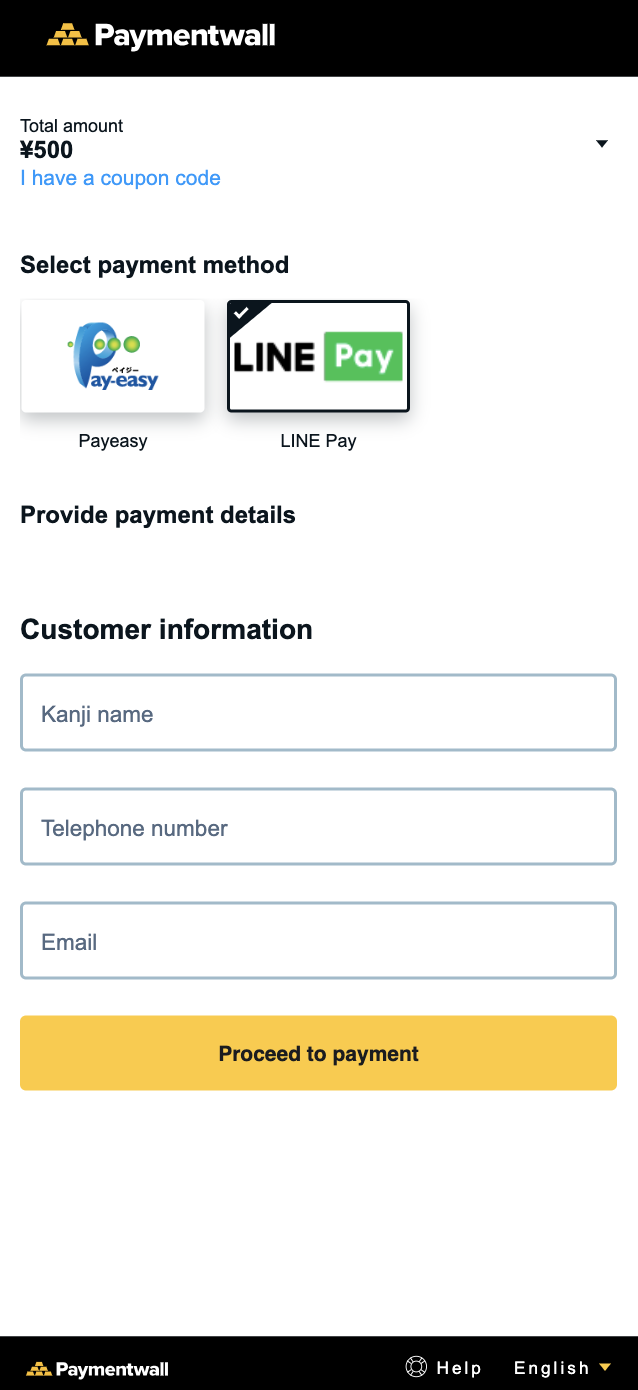

-

Step 1: Choose LINE Pay.

-

Step 2: The user is required to add their name, telephone number, and email address.

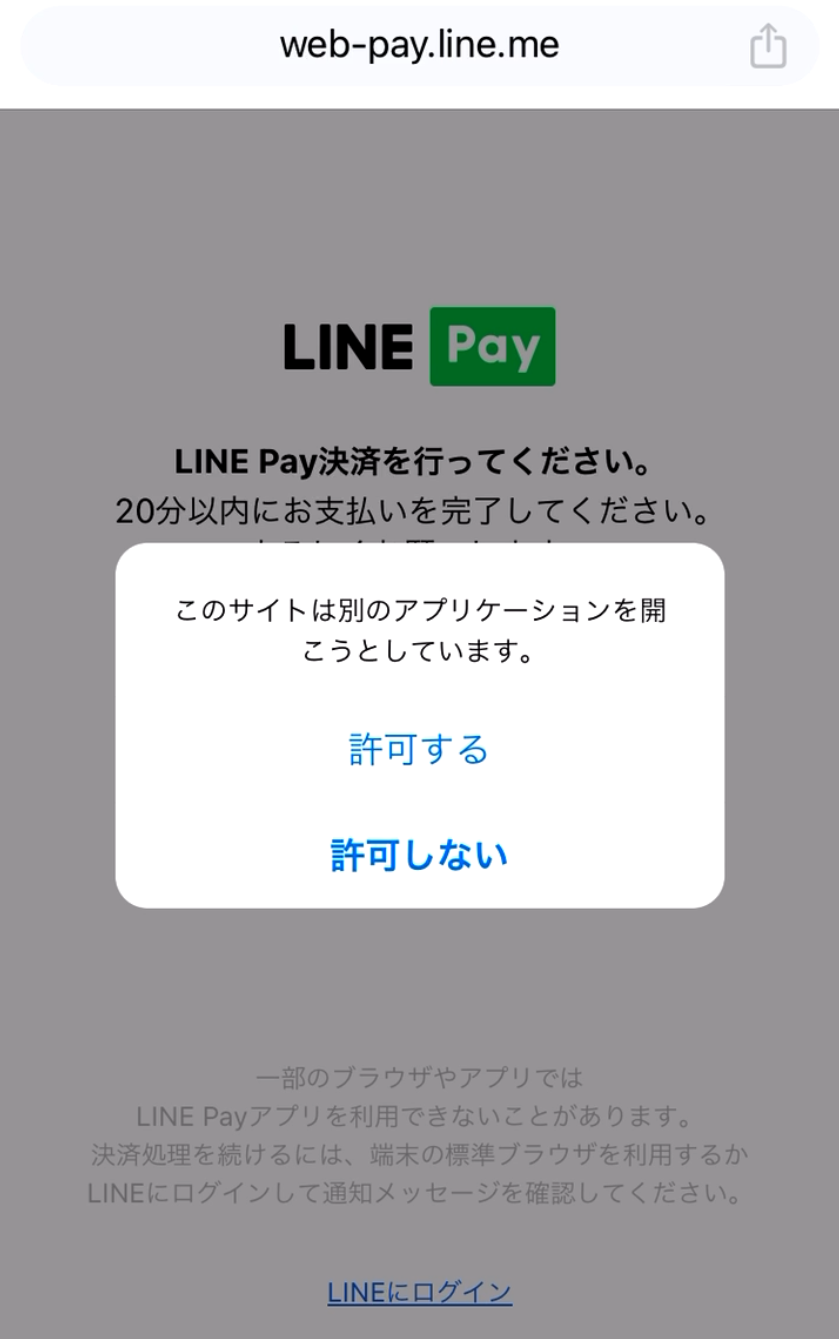

- Step 3: The user will be redirected to LINE Pay app to authenticate the transaction.

- Step 4: The user will receive a prompt confirming that the funds have been successfully deducted from your wallet.

Linepay Japan

| name | description |

|---|---|

| Countries |  JP JP |

| Type | E-Wallets |

| Processing currencies | JPY |

| Payment confirmation time | Instant |

| Chargebacks | Yes |

| Chargebacks type | Manual |

| Refunds | Yes |

| Partial refund | No |

| Refund time frame | 30 days |

| Onboarding required | Yes |

| Recurring Payments | No |

| Mobile UI | Yes, Native UI available with Mobile SDK |

| Opens new window | Yes |

| Min Transaction Limit | 1 JPY |

| Min Transaction Limit | 9.99 million JPY |

Available models:

- Merchant.

Included with your Paymentwall account.

- MOR.

Questions?

Common questions are covered in the FAQ.

For integration and API questions, feel free to reach out Integration Team via integration@paymentwall.com.

For business support, email us at merchantsupport@paymentwall.com.

To contact sales, email bizdev@paymentwall.com.

To suggest a change to this documentation you can submit a pull request on GitHub.